We’ve stood the test of time and

the test of market conditions.

From humble beginnings, the Stephens Group has built over 90 years of investing expertise across various industries, growing, refining focus, and benefitting portfolio partners. Yet, one thing has never changed and that is remaining true to the enduring values that are and have always been core to our success. We’re always looking ahead. The Stephens Family was doing private equity before it was private equity.

Beginnings

Humble Beginnings: 1920s – 1930s

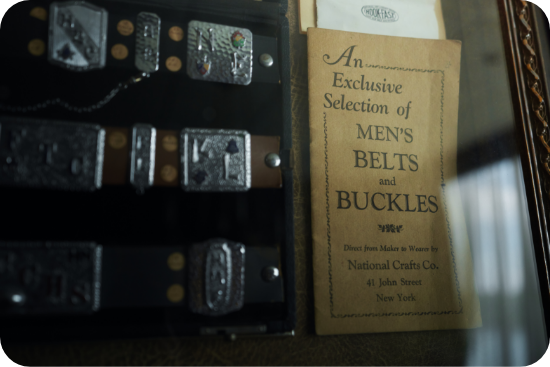

1927

W.R. (Witt) Stephens begins selling belt buckles and other jewelry for the National Crafts Company as well as Bibles on the side. An extraordinary salesman, his sharp business acumen led to quick success.

1933

Witt invests his own capital in and begins trading Arkansas Highway bonds which were selling at Depression Era lows. Soon after, Witt forms W.R. Stephens Investment Company in 1933, which would become the premier bond house in the Southeastern U.S. and the predecessor to Stephens Inc., which would eventually develop into the largest investment banking firm off Wall Street.

Partnerships

The Stephens Brothers and Enduring Partnerships:

1940s – 1960s

Early 1940s

The municipal bonds in which Witt invested in early in his career pay off at par. By that time, Witt has gained a reputation for bond expertise and sound financial advice.

1945

President Roosevelt pushes to break up utility holding companies – Witt pays $1.2 million for the Fort Smith Gas Corporation (now AOG). Witt’s family would own AOG for over 70 years until its sale in 2017.

Late 1940s

Witt acquires extensive natural gas interests, controlling much of the gas production and distribution in Arkansas. He invests in numerous small banks, as well as other utilities, and makes many other investments in a wide variety of companies.

1946

Witt’s younger brother, Jackson T. “Jack” Stephens, joins the firm, beginning what would be a 60-year, handshake business partnership between Witt Sr., Jack and their immediate families.

1947

Stephens sells Grant County Telephone Co. to Hugh Wilbourn and Charlie Miller, launching a 70-year relationship that would lead to one of Stephens’ most successful investments, global telecom giant Alltel.

1953

Stephens buys Oklahoma Production Company, beginning a relationship with the Walker family spanning three generations and over 60 years. This acquisition served as the foundation for a new natural gas exploration company, Stephens Production Company (now Stephens Natural Resources). This partnership endures today with Bill Walker, (the grandson of the founder and President of the company in 1953) and Witt Stephens, Jr. overseeing the company’s oil and gas exploration and production interests for the combined Stephens Families.

1954

Stephens acquires Arkansas Louisiana Gas Company (Arkla) and Witt assumes direct management oversight of it in 1956, leaving leadership of the investment firm in his brother Jack’s hands. Over the next 17 years, Witt turns Arkla into one of the best performing utility companies in the U.S.

1963

The Stephens Family furthers its relationship with the Ford Family, providing advice and support to Allied Telephone when Joe Ford was an employee. Joe became President of Allied in the late 70’s, with his son Scott becoming CEO in 2002. This relationship has spanned over 70 years and continues today with Scott Ford serving as an advisor to The Stephens Group and numerous common investments between the Ford and Stephens families.

1968

Stephens backs Walter Smiley to create Systematics, a partnership that will span over 40 years. Systematics becomes a leader in bank data processing and is ultimately acquired by Alltel.

Acceleration

Active Investing Accelerates:

1970s – 1990s

1970

Stephens Inc. takes Wal-Mart public.

1973

Witt leaves his post at Arkla after 17 years to return to Stephens Inc.

1981

Witt’s daughter Elizabeth S. Campbell joins the family firm.

1985

Stephens steps in to recapitalize struggling Worthen Banking Corporation, an investment that will ultimately become part of Bank of America. To this day, Stephens has maintained its equity investment through various iterations.

1986

Witt and Jack Stephens create Stephens Group, Inc. to hold all of the private holdings of the combined Stephens Family other than the investment bank, Stephens Inc.

1988

The Stephens family receives national notice for backstopping a $100mm equity investment to facilitate Tyson Food’s acquisition of Holly Farms, one of the earliest innings in the large-scale consolidation of the chicken processing industry.

1990

Alltel Corporation acquires Systematics, and Stephens becomes one of its largest shareholders.

1990s

Stephens makes numerous large equity investments, including in consumer and foodservice equipment manufacturer Viking Range; Donrey Media Group (renamed Stephens Media) and its array of newspapers (including the Las Vegas Review-Journal), advertising, and cable and TV operations; and Texas-based retailer Conn’s.

1991

Witt Stephens, Sr. passes away.

1991

Witt Stephens, Jr. assumes an active role in the family firm, first working with the management team of what was then Stephens Production Company. In 1996, he becomes assistant to Jack Stephens. Throughout this time, he was actively involved in the energy private investments as well as the management of Stephens Media after it was acquired in 1993.

Transition

Family Transition: The

2000s

The Early 2000s:

Additional significant equity investments are made, including partnering with Ray Davis and Kelcy Warren in Energy Transfer, and a large stake in the investment management firm, Hotchkis & Wiley. Both remain holdings of the family.

2000

Witt Stephens, Jr. assumes oversight of the combined Stephens family energy and natural resource holdings.

2005

Jack Stephens passes away, marking the end of the Stephens brothers’ 60-year partnership and setting the stage for the transition of the Stephens legacy to the next generation.

2006

Witt Stephens, Jr. and Elizabeth S. Campbell sell their interests in Stephens Inc. and assume the name Stephens Group, LLC to focus solely on principal investing. The Stephens Group, LLC launches with a full team of deeply experienced investment professionals and Witt Stephens, Jr. assumes the CEO role.

2007

Alltel is acquired by TPG and Goldman Sachs in a transaction valued at $27.5 billion; Stephens exits the investment after nearly 40 years.

2010

In the first five years, The Stephens Group capitalizes on uncertain markets and invests over $300 million in 14 private companies.

Growth

Combining Permanent Capital with Leading Private Equity Capabilities 2010 – Present

2011

The Stephens Group begins to add a more structured operating discipline and executives to its ranks to complement the investment professionals and the many industry executives that have long been among its advisors.

2012

A number of repeat company partnerships continue to build significant value for the family and its partners, including multiple investments each with The Sterling Group, New Heritage Capital, Altas Partners, and numerous families, and executives from prior Stephens portfolio companies.

2016

In the decade after Witt, Jr. and Elizabeth formed The Stephens Group as a private family investment firm, equity capital invested surpasses well over $1.5 billion, comprising over 30 platform companies and many more portfolio add-on acquisitions and new growth investments.

Building on over 90 years of experience investing across various industries, The Stephens Group actively seeks new company partnership opportunities. It continues to grow rapidly, and at the same time refine its focus, placing emphasis on several industry verticals and building its capabilities through the addition of strategic and other resources for the benefit of its portfolio partners. By providing its partners with authenticity and transparency in all interactions, The Stephens Group remains true to the enduring values that are and have always been core to its success.